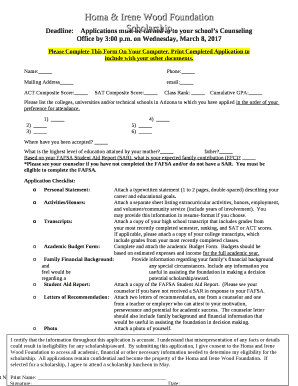

Canada CF2553 - British Columbia 2004-2025 free printable template

Show details

This form is used to record expenses associated with respite benefits under the At Home Program and Direct Funded Respite Benefits, ensuring eligibility and confidentiality as per privacy regulations.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign respite forms

Edit your respite form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fscd record of services provided form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssah respite worker form pdf online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit record expenses form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expense templates form

How to fill out Canada CF2553 - British Columbia

01

Obtain the Canada CF2553 form from the official government website or a local office.

02

Fill in your personal information such as name, address, and contact details in the designated sections.

03

Indicate your business name and registration number, if applicable.

04

Provide details regarding the nature of the business in the space provided.

05

Ensure that you complete any required financial information, including income and expenses.

06

Sign and date the form to certify that the information provided is accurate and complete.

07

Submit the completed form either online, by mail, or in person to the designated authority.

Who needs Canada CF2553 - British Columbia?

01

Individuals and businesses in British Columbia that are applying to designate or change their tax status under specific regulations.

02

Those who need to report their income and expenses for tax purposes.

03

Business owners seeking to clarify their tax obligations and benefits with the Canadian tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

Does Excel have an expense report template?

Select an Excel expense report template from this page, and plug in your expenses for timely reimbursement from your employer. To get started with your claim for reimbursement for your travel or other business expenses, download an Excel expense report from this page.

How do I create an expense form in Excel?

Using the Expense Report Template in Excel: For each expense, enter the date and description. Use the dropdown menus to select payment type and category for each expense. For each expense, enter the total cost. Attach all necessary receipts to the document. Submit for review and approval!

How do I create an expense report form?

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

Does Quickbooks have an expense report form?

This is a simple expense report template to record the type of business expenses, the related amount, and the date on which the expenses were incurred. Further, you can customise this sheet to include more columns as per need.

How do I make a simple expense report?

The process for building an expense report is fairly straightforward: Determine what expenses you want to include in your report. List the expenses that meet your criteria, including the details listed above. Total the expenses included in your report. Add notes about expenses incurred or total paid.

What is an expense report form?

An expense report is a form that tracks your business's spending. In small businesses, expense reports are used when employees pay out-of-pocket for business expenses. Taxes are a large reason why small businesses need to use expense reports. Expense reports are crucial for helping track work-related expenditures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada CF2553 - British Columbia to be eSigned by others?

Canada CF2553 - British Columbia is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I fill out Canada CF2553 - British Columbia on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your Canada CF2553 - British Columbia from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit Canada CF2553 - British Columbia on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada CF2553 - British Columbia. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Canada CF2553 - British Columbia?

Canada CF2553 is a tax form specific to British Columbia, Canada, used by certain corporations to report information related to their tax obligations and eligibility for various tax credits.

Who is required to file Canada CF2553 - British Columbia?

Entities that operate as corporations in British Columbia and are seeking specific tax benefits or reporting exemptions may be required to file Canada CF2553.

How to fill out Canada CF2553 - British Columbia?

To fill out Canada CF2553, a corporation should gather the required financial documents, complete the form diligently with accurate information regarding income, expenses, and applicable credits, and submit it as per the guidelines provided by the Canada Revenue Agency.

What is the purpose of Canada CF2553 - British Columbia?

The purpose of Canada CF2553 is to ensure that corporations comply with provincial tax regulations and to facilitate the assessment of tax liabilities and eligibility for provincial tax incentives.

What information must be reported on Canada CF2553 - British Columbia?

Information that must be reported on Canada CF2553 includes corporate identification details, financial statements, income details, applicable deductions, and information pertinent to provincial tax credits.

Fill out your Canada CF2553 - British Columbia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada cf2553 - British Columbia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.